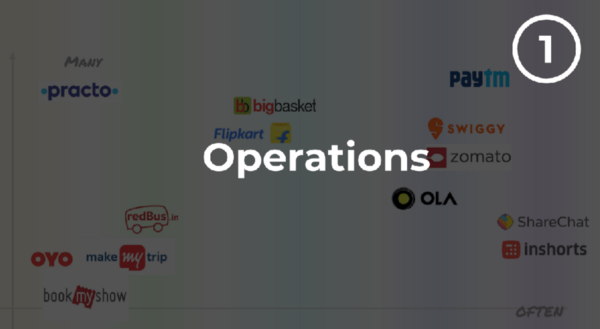

In the previous post, we established the axes and plotted startups on it. The 4 quadrants with representative startups for each If we label these quadrants, we can talk about the characteristics that define them.

Quadrant 1 : Top-right

It’s easy to talk of this quadrant but hard to get there. This is the golden quadrant most startups want to be in. With a potential chance to move to farther top-right, the unicorn territory.

The golden quadrant

What is characteristic of this quadrant is that all these companies need to operate at scale. They’re all basically ops companies handling millions of consumer transactions every day, err… every hour. And they need to be really good at that. Imagine the user experience if Ola says ‘servers unreachable’ even for 10 minutes. Scary right!

The golden quadrant

What is characteristic of this quadrant is that all these companies need to operate at scale. They’re all basically ops companies handling millions of consumer transactions every day, err… every hour. And they need to be really good at that. Imagine the user experience if Ola says ‘servers unreachable’ even for 10 minutes. Scary right!

Not everybody needs or wants to get to quadrant 1, but it really helps if you do. More on that when we talk about competition.

Quadrant 2 : Top-left

What’s the most important thing for a company you don’t often have a need of?

Recall.

Well then, most companies in quadrant 2 become marketing companies. Okay, maybe the word ‘become’ is misleading. It’s more appropriate to say marketing is where these companies should spend most of their energy on.

Well then, most companies in quadrant 2 become marketing companies. Okay, maybe the word ‘become’ is misleading. It’s more appropriate to say marketing is where these companies should spend most of their energy on.

As a startup, yes you’ll need a solid product to attract attention away from incumbents (example CoverFox), but you need to retain and grow that attention tirelessly which is essentially… marketing.

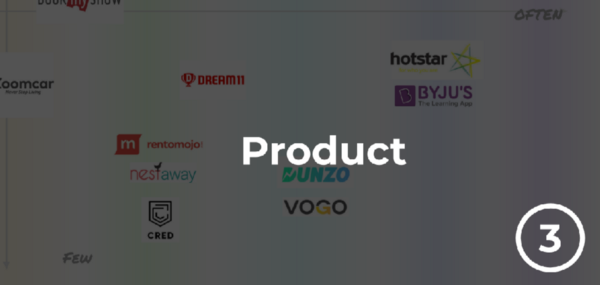

Quadrant 3 : Bottom right

Startups that do something innovative and disruptive fall here. They are trying to invent new business models. While they may be addressing a smaller segment right now, they will eventually scale vertically if execution goes well.

Scaling up vertically into more markets needs strong product focus and that’s why these would be aptly called product startups. They got to product-market fit with one product and will now have to expand their offering from there.

Scaling up vertically into more markets needs strong product focus and that’s why these would be aptly called product startups. They got to product-market fit with one product and will now have to expand their offering from there.

A startup that’s headed into golden quadrant(1) usually comes more often from this quadrant than quadrant 2.

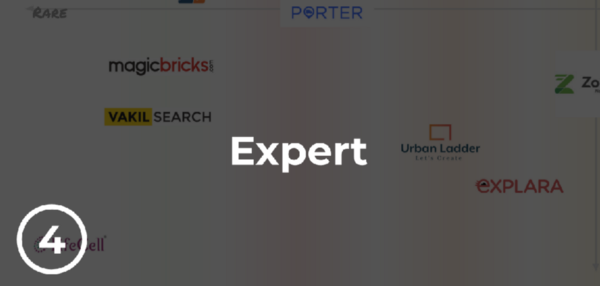

Quadrant 4 : Bottom left

The farther bottom left you’re on the graph, the more you need to be an *expert, **either in the subject or sales.

If you have something that a very specific set of people need and not very often, then these customers want to trust that you’re the *right company to do it. Typically services fall into these regions. Design firms, marketing agencies etc.

If you have something that a very specific set of people need and not very often, then these customers want to trust that you’re the *right company to do it. Typically services fall into these regions. Design firms, marketing agencies etc.

Btw, MagicBricks and Explara are obviously not experts in subject. But they better be experts in sales and partnerships if they have to stay relevant and alive.

Of course, it’s not that simple

By defining a single characteristic for startups in each quadrant, we obviously do not want to discount the role other aspects play.

For example, as popular as Swiggy is when it comes to food delivery, it simply can’t afford to leave slack in marketing. Especially when there are competitors.

And just because Cred is just getting started, it doesn’t mean they aren’t going to invest in stable back-end operations.

Another tricky thing: the points where the axes divide the quadrants are very subjective. Does Zoomcar need more product innovation or sales innovation. Or can it just market its way better than competitors etc.

Complete picture

All 4 quadrants with their primary characteristic

In the next post, we discuss competition. The exciting arena where clever startups hold their ground and cleverer startups de-throne them.

All 4 quadrants with their primary characteristic

In the next post, we discuss competition. The exciting arena where clever startups hold their ground and cleverer startups de-throne them.