I ended up conceptualizing a framework while evaluating the market opportunity for my own startup, ImageTranslate.

It ended up being quite insightful that I thought I should share it with more people.

HMHO stands for How Many & How Often. Nothing fancy. 😄 What it means is ‘how many people can possibly use this product’ and ‘how often are they going to’.

Ready for the basic plots?

HMHO base diagram

Now let’s put some example markets on this graph to give it more meaning.

HMHO base diagram

Now let’s put some example markets on this graph to give it more meaning.

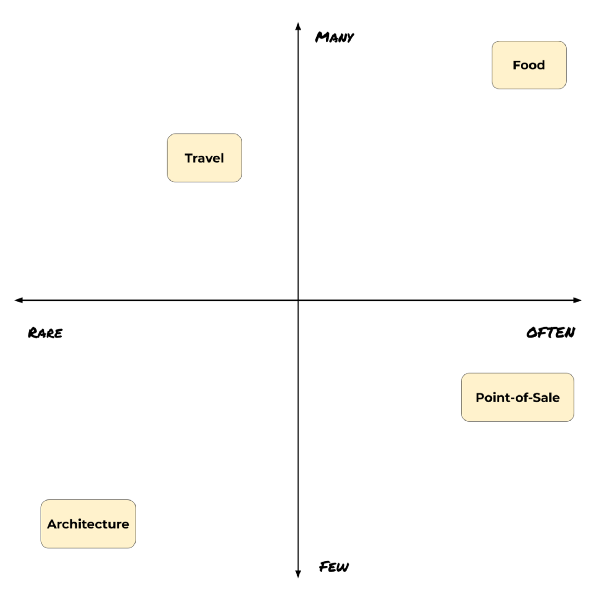

An example for each quadrant

Food

Every single person on the planet needs it, and needs it 3 times a day.

An example for each quadrant

Food

Every single person on the planet needs it, and needs it 3 times a day.

Travel Lot of people travel. But not all. And they don’t travel as often.

Point-of-Sale Merchants use PoS. They’re not too many of them. But its their everyday tool.

Architecture A small set of humans avail this. Even they probably do so only once in a lifetime.

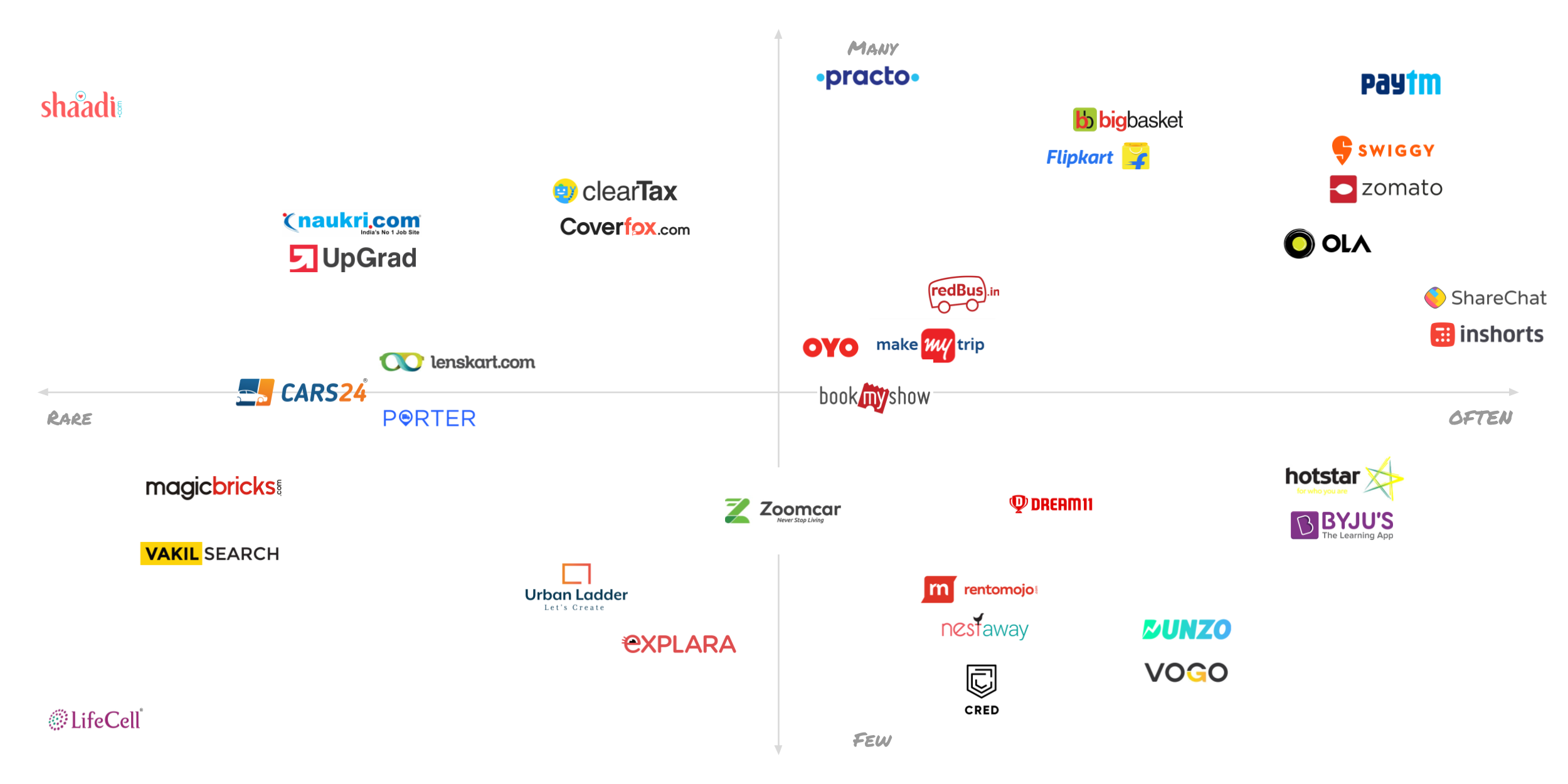

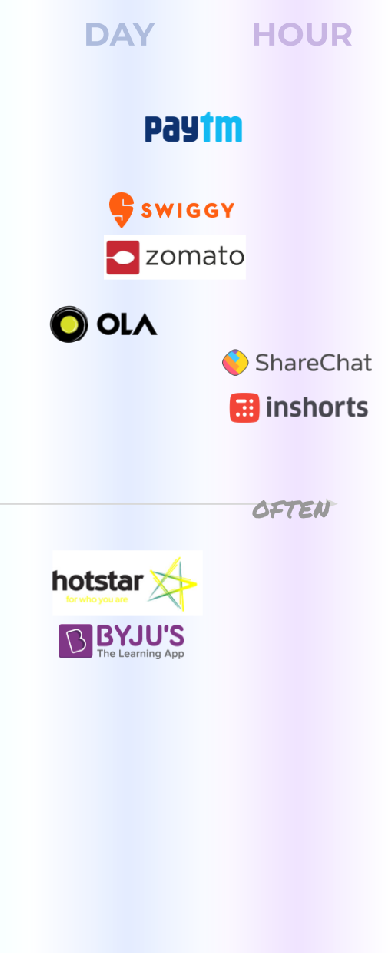

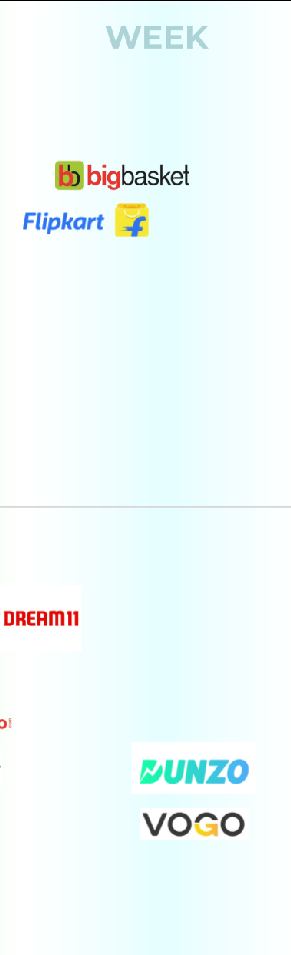

Plotting startups. The fun begins!

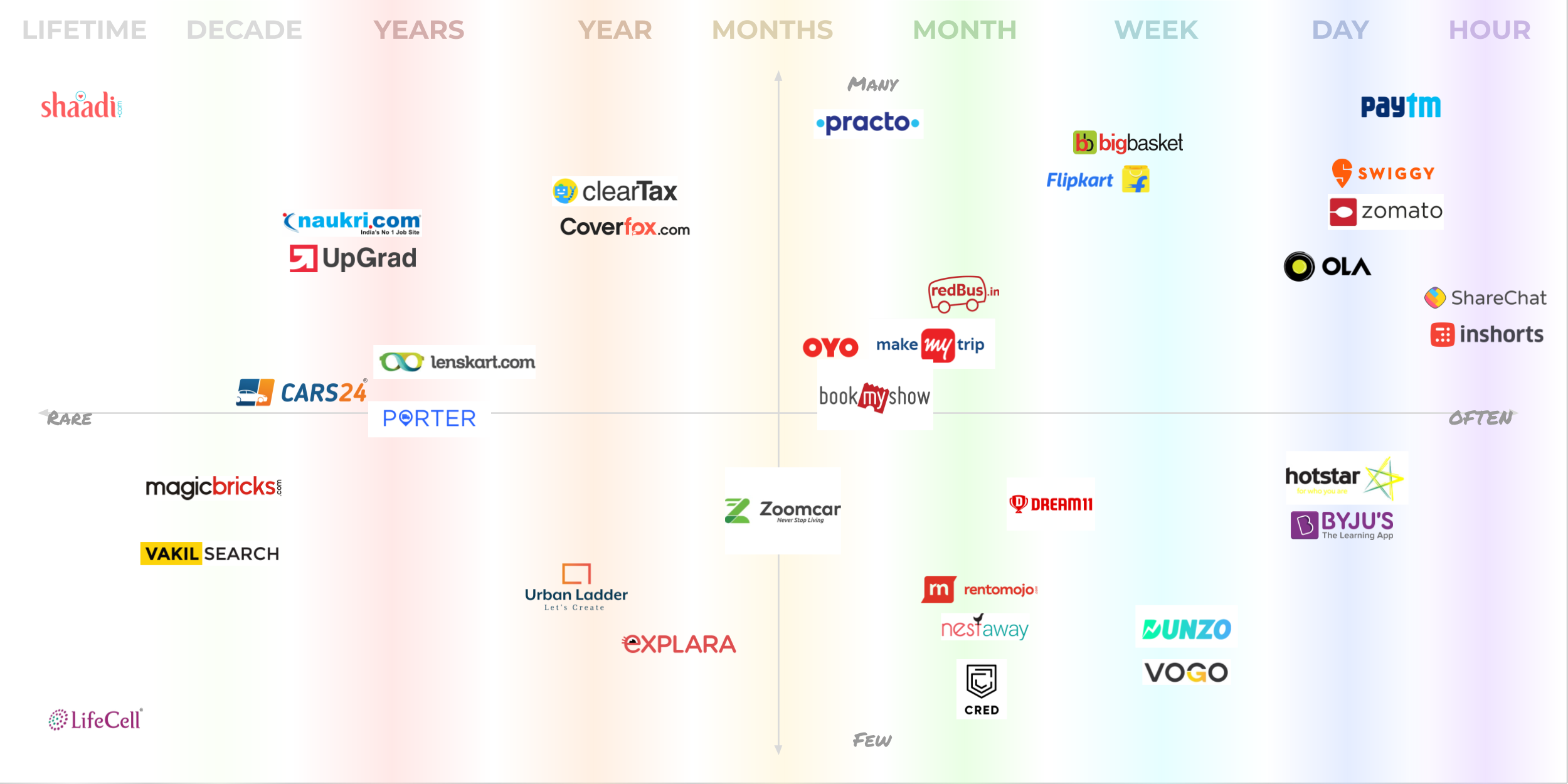

Now that we’ve plotted sample markets, let’s plot startups. I’m primarily going to deal with Indian startups because I understand them better. Or let’s say I use their products and service more than the non-Indian startups.

That’s a lot to take in!

I know it’s overwhelming and we haven’t covered even 25% of the popular startups. There is no particular reason to choose only these startups. They’re just representative of the position and market they operate in.

That’s a lot to take in!

I know it’s overwhelming and we haven’t covered even 25% of the popular startups. There is no particular reason to choose only these startups. They’re just representative of the position and market they operate in.

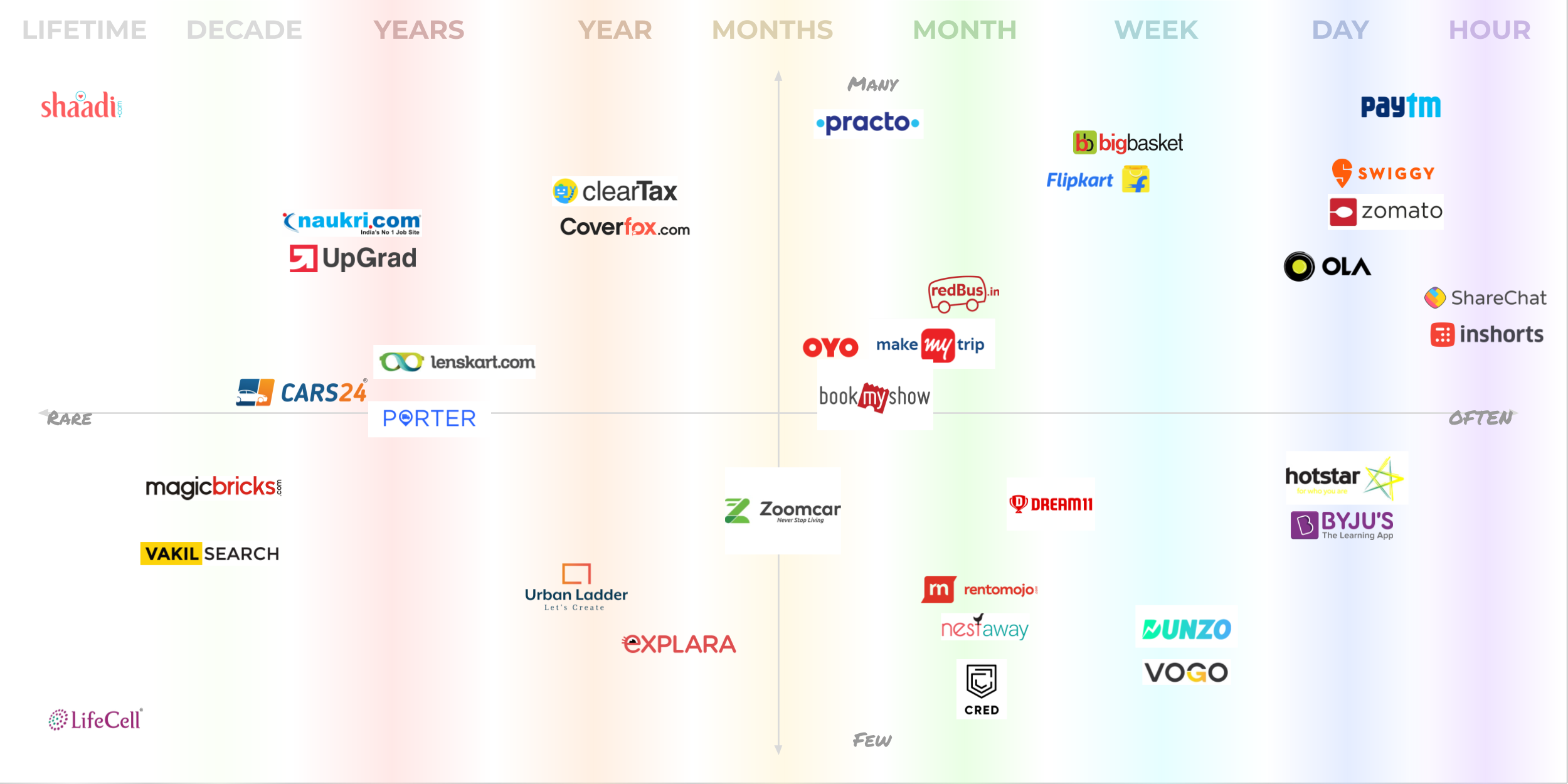

Now let’s add time to the mix!

Segmented by frequency. Frequency indicates how often a user interacts with a product/service.

You should understand this graph slowly going over each company.

No really. Spend a minute and then we’ll dive into it.

Segmented by frequency. Frequency indicates how often a user interacts with a product/service.

You should understand this graph slowly going over each company.

No really. Spend a minute and then we’ll dive into it.

Category one

- News and media demand attention of every kind of people. Every hour. No wonder the most valuable startup in the world is then ByteDance and not Uber.

- Paytm, the new darling of Indian startup scene (older being Flipkart)is rightly placed so. Top-goddamn-right. Earlier most new entrants wanted to do E-com. Now everyone wants to do FinTech.

- Food is a sector that won’t be exhausted anytime soon. And Swiggy and Zomato don’t have plans to stop till the end of Y-axis is reached.

- There’s nothing much to add about Ola besides the perennial tug-of-war with Uber.

- Hotstar is doing quite impressive. The only problem here is that there is too much competition now.

- Byju’s, a startup with customer segment as students ending up in the unicorn space?! Maybe that talks of our Indian obsession with education. Meh.

Category Two

- There’s nothing glorious about eggs, toothpaste and shampoo but but you need them every week. BigBasket of course doesn’t have a user-base bigger than Flipkart’s but if they play long enough, they will. Also, why do you think Flipkart is that keen on grocery?

- Flipkart is doing good. Except that a foreign player, Amazon, entered this plot with too many resources. Their stand is still very admirable.

- Dream11 basically hit a sixer on the ball called Indians’ fanaticism with cricket. Cricbuzz and Cricinfo were always there. But I guess they didn’t want to venture into the grey areas.

- Dunzo is something small with a chance to make it obscenely big. Getting things from point A to point B will disrupt multiple markets. Just wait and watch.

- Vogo is Zoomcar for bikes. Right now delivery guys like it. Eventually lot of others will.

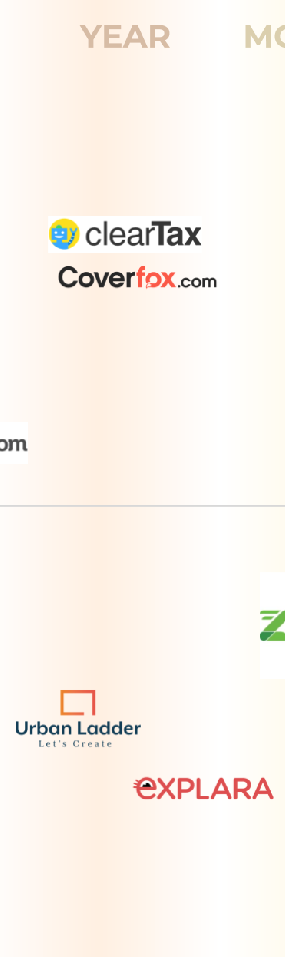

Category 3

- Every single human falls ill at some point of time or other. When they do, they no longer think of their doctor. They think of Practo. That’s something!

- MMT, BMS, RedBus and OYO all deal with travel. But this space has natural limits for an ambitious company. Not all people travel and not that often. OYO is eyeing co-working and co-living spaces. Both bigger markets with higher frequency.

- Zoomcar is the pioneer that spawned 20 other companies. Brave. And a beautiful UI btw.

- Rentomojo and Nestaway are just 2 examples in the housing category. There are atleast 10 similar competitors. This is the SaaS subscription equivalent for B2C. Sweet!

- Cred is this fancy thing from Kunal Shah for paying CC bills. The app is slick. But I am wondering how big the market is to justify a $100mn investment.

Category 4

- Taxes and insurance are once-in-a-year-thing. But damn. Almost everyone has to do them whether or not they like them. ClearTax and CoverFox atleast make it painless.

- Furniture is also a one year to two year thing. Urban Ladder prices everything obscenely high and still seems to be going strong. I really am wishing for Indian Ikea that delivers to home.

- Explara is one example for all ticketing startups. The market is very limited and diverse at the same time. Not an easy place to operate.

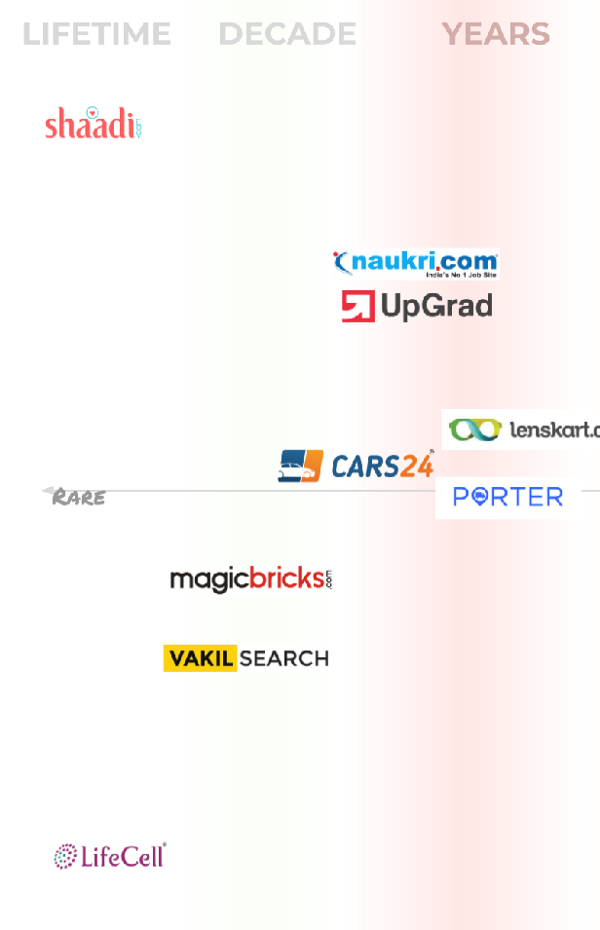

Category 5

- What are things people do every few years? Change jobs, buy vehicles, move houses. Obvious once you see it.

There are a *lot *of new ideas here.

- People buy homes once in multiple decades maybe. But the margins on each transaction can be in lakhs. Selling matters more than anything for somebody like MagicBricks.

- VakilSearch basically made a service look like a product. But legal and paperwork in India is a pain. So unless someone challenges them in this space, they’re here to stay.

- Shaadi and Lifecell are just out here as anchors. Almost everyone gets married once in a lifetime. Almost no-one(0.1% of rich) affords stem cells storage* once in a lifetime*.

Full perspective

Let’s repeat the image again. To see everything in perspective.

There’s no right or wrong place to be in this plot

I know, not everyone agrees with this framework. And that’s ok.

Remember:

There’s no right or wrong place to be in this plot

I know, not everyone agrees with this framework. And that’s ok.

Remember:

All models are wrong, but some are useful

You will discover the usefulness of this as we explore more in subsequent posts.

In the next post, we’ll identify what each of these quadrants signify and about the DNAs of the startups in them.